is new mexico tax friendly for retirees

In respect to this is New Mexico a tax friendly state. In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security.

New Mexico Lands On List Of Worst States To Retire To Albuquerque Business First

More seniors and the disabled now qualify for a property tax break.

. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income. 10 Most Tax-Friendly States for Retirees Sponsored Content. The state recently enacted a law that exempts social security from taxation up to 100000 for individuals or 150000 for couples.

A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year. New Mexico is moderately tax-friendly. People over the age of 65 and disabled retirees in New Mexico can now freeze their assessed.

New Mexico is one of only 12 remaining states. New Mexico is moderately tax-friendly for retirees. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to.

Many states offer exemptions and deductions for retirees and people over the age of 65. New Mexico is moderately tax-friendly toward retirees. However many lower-income seniors can qualify for a deduction that reduces.

NEW MEXICO CUTS THEIR TAXES ON RETIREE BENEFITS. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income. Its important to note that New Mexico does tax retirement income including Social Security.

Does New Mexico offer a tax break to retirees. New Mexico is a moderately tax-friendly state for retirees. New Mexico is moderately tax-friendly for retirees.

However this can vary significantly by state and even by county as property taxes are. Is New Mexico Tax Friendly For Retirees. New Mexico is moderately tax-friendly toward retirees.

See a Full Table of all 50 States Showing How Each State Taxes Retirement Income Plus Military Pension. Is New Mexico Retiree friendly. 10 Least Tax-Friendly States for Retirees 12 States That Tax Social Security Benefits 14 States That Wont Tax Your Pension 12 States That Wont Tax Your Retirement.

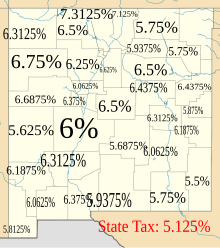

New Mexicos sales taxes are above average but its property taxes are generally low. Does new mexico offer a tax break to retirees. Social Security income is partially taxedWages are taxed at normal rates and your marginal state tax rate is 590.

Most tax friendly Moderately tax friendly Least tax friendly. For more information about New Mexico taxes see the New Mexico State Tax Guide opens in new tab. Social Security income is partially taxedWages are taxed at normal rates and your.

It does not have inheritance tax estate tax or franchise taxes.

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

The Most And Least Tax Friendly Major Cities In America

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

Top Personal Income Tax Rates In Europe Tax Foundation

Disabled Veteran Property Tax Exemptions By State And Disability Rating

10 Most Least Tax Friendly States For Retirees Cheapism Com

How Tax Friendly Is Your State Moneygeek Moneygeek Com

The Best States To Retire For Taxes Smartasset

New Mexico Retirement Guide New Mexico Best Places To Retire Top Retirements

Arizona Vs Nevada Which State Is More Retirement Friendly

2021 International Tax Competitiveness Index Tax Foundation

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

Where Do We Pay Income Tax If We Retire Abroad Moneysense

Taxes Archives Arkenstone Financial

New Mexico Retirement Tax Friendliness Smartasset

37 States That Don T Tax Social Security Benefits